Facts About Medicare Advantage Agent Revealed

Table of ContentsEverything about Medicare Advantage AgentMedicare Advantage Agent Can Be Fun For EveryoneNot known Facts About Medicare Advantage AgentOur Medicare Advantage Agent StatementsRumored Buzz on Medicare Advantage AgentThe 7-Minute Rule for Medicare Advantage Agent

The amounts vary by strategy. Your wellness strategy may pay 80 % of the expense of a surgical procedure or healthcare facility remain.

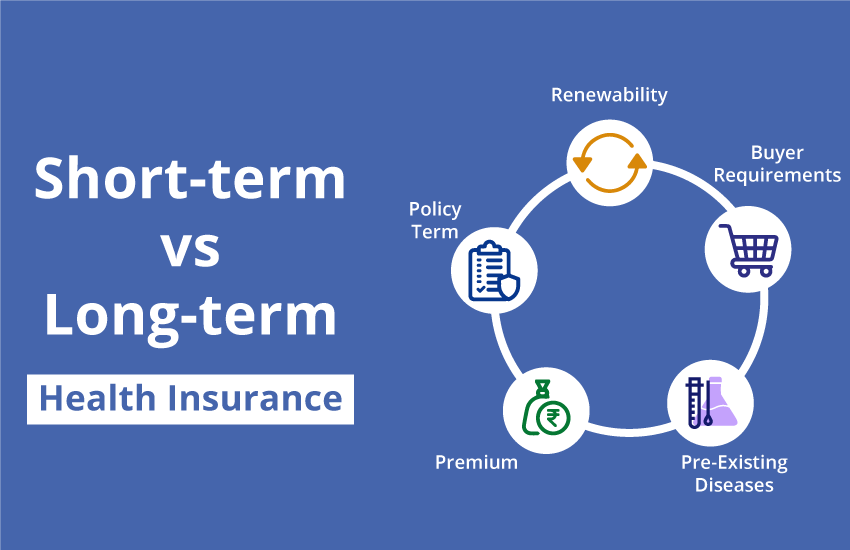

A plan year is the 12-month duration from the day your insurance coverage started. If your coverage started on September 1, your strategy year lasts until August 31. Learn a lot more: How to save money at the physician Treatment choices and costs There are 4 sorts of significant medical health strategies in Texas.

The four kinds are: HMO plans. Special copyright (EPO) plans. Preferred service provider (PPO) plans. Point-of-service plans. All four types are managed treatment strategies. This implies they agreement with physicians and various other health and wellness care companies to treat their members at discounted rates. These companies compose a strategy's network. Managed care strategies restrict your choice of medical professionals or encourage you to make use of medical professionals in their networks.

An Unbiased View of Medicare Advantage Agent

The plans differ in the extent to which you can use physicians outside the network and whether you must have a doctor to oversee your care. You need to make use of carriers in the HMO's network. If you don't, you might need to pay the full price of your care yourself. There are exceptions for emergency situations and if you need care that isn't offered in the network.

If the anesthesiologist is out of your health insurance plan's network, you will obtain a shock costs. This is also known as "equilibrium payment." State and federal laws secure you from shock medical bills. Learn what expenses are covered by surprise invoicing regulations on our web page, Just how customers are shielded from shock clinical costs To learn more about obtaining assist with a surprise bill, visit our page, How to get aid with a surprise clinical costs.

You can utilize this period to join the plan if you didn't previously. You can additionally use it to drop or transform your insurance coverage. Strategies with higher deductibles, copayments, and coinsurance have lower premiums. But you'll need to pay even more out of pocket when you get care. To learn a company's economic ranking and problems history, call our Customer service or visit our web site.

An Unbiased View of Medicare Advantage Agent

Know what each plan covers. If you have physicians you desire to keep, make certain they're in the strategy's network.

Make sure your medicines are on the plan's checklist of accepted drugs. A plan won't pay for drugs that aren't on its checklist.

The Texas Life and Wellness Insurance coverage Guaranty Organization pays claims for health insurance policy. It doesn't pay claims for HMOs and some other kinds of strategies.

Your partner and children additionally can continue their coverage if you take place Medicare, you and your spouse separation, or you die. They have to have gotten on your plan for one year or be younger than 1 years of age. Their coverage will certainly end if they obtain other insurance coverage, don't pay the costs, or your employer quits providing medical insurance.

The smart Trick of Medicare Advantage Agent That Nobody is Talking About

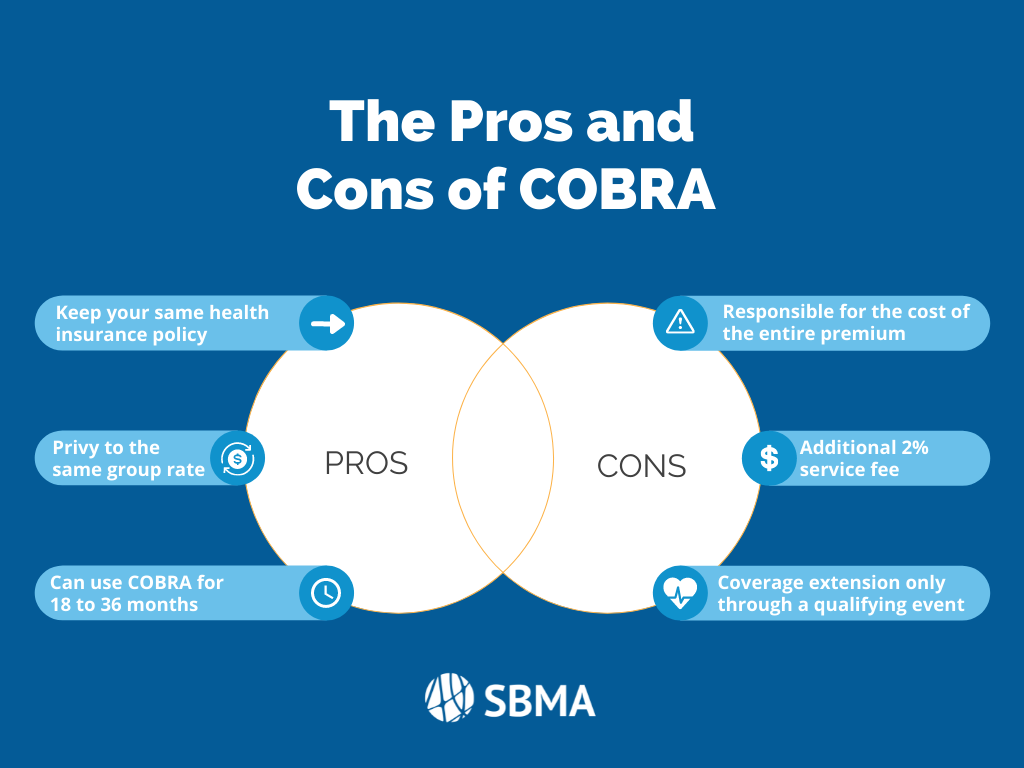

If you continue your coverage under COBRA, you must pay the premiums on your own. Your COBRA insurance coverage will certainly be the exact same as the protection you had with your employer's strategy.

State continuation allows you keep your protection even if you can't get COBRA. click this site If you aren't qualified for COBRA, you can proceed your protection with state extension for 9 months after your work finishes (Medicare Advantage Agent). To obtain state extension, you have to have had insurance coverage for the 3 months prior to your work finished

If you have a wellness strategy via your company, the company will have info on your plan. Not all health plans cover the very same services in the exact same method.

Some Known Facts About Medicare Advantage Agent.

It will also inform you if any solutions have restrictions (such as maximum quantity that the health insurance will certainly pay for sturdy medical tools or physical therapy). And it should inform what services are not covered in any way (such as acupuncture). Do your homework, study all the choices readily available, and examine your insurance plan before making any type of decisions.

It must tell you if you need to have the health insurance license care before you see a service provider. It needs to also inform you: If you need to have the plan accredit care prior to you see a provider What to do in situation of an emergency situation What to do if you are hospitalized Keep in mind, the wellness plan might not spend for your services if you do not comply with the proper procedures.

When you have a clinical treatment or go to, you generally pay your health and wellness treatment provider (medical professional, health center, therapist, and so on) a co-pay, co-insurance, and/or description a deductible to cover your portion of the copyright's bill. Medicare Advantage Agent. You expect your health insurance plan to pay the rest of the bill if you are seeing an in-network company

Rumored Buzz on Medicare Advantage Agent

There are some situations when you may have to file a claim yourself. This can take place when you most likely to an out-of-network supplier, when the supplier does decline your insurance coverage, or when you are traveling. If you need to submit your very own medical insurance claim, more tips here call the number on your insurance card, and the consumer assistance agent can inform you just how to submit an insurance claim.

Lots of health insurance have a time limit for for how long you need to submit an insurance claim, typically within 90 days of the service. After you submit the claim, the wellness plan has a restricted time (it varies per state) to educate you or your copyright if the health insurance plan has approved or denied the insurance claim.

If it decides that a service is not clinically necessary, the plan might reject or reduce repayments. For some health insurance, this medical need choice is made before treatment. For other wellness strategies, the decision is made when the business obtains a costs from the service provider. The business will certainly send you a description of benefits that describes the service, the quantity paid, and any kind of added quantity for which you may still be responsible.